401k rmd tables

The IRS introduced updated life expectancy tables effective January 1 2022. Repeat steps 1 through 3 for each of your IRAs.

Is There New Required Minimum Rmd Tables For 2022 Michael Ryan Money Financial Coach

Distribution period from the table Table III for your age on your birthday this.

. Traditional rollover SIMPLE and SEP. Step 2 Calculate your RMD with the IRS RMD Tables. The Required Minimum Distribution shortly known as RMD is the minimum amount a retiree needs to withdraw from their account every year after.

RMD Tables 2022 - 2023. Uniform Lifetime Table for all unmarried IRA owners calculating their own withdrawals married. If you are the original account owner your RMD is calculated by dividing prior year-end account balances by a life expectancy factor in the IRS Uniform Lifetime Table PDF.

In This Article RMD Rules New RMD Tables. Chart RMD New Uniform. Chart of required minimum distribution options for inherited IRAs beneficiaries Publication 590-B Distributions from Individual.

After reaching age 72 required minimum distributions RMDs must be taken from these types of tax-deferred retirement accounts. Step 4 Calculate Your RMD. Under the old table the divisor was 229.

FAQs on Required Minimum Distributions. Tables to calculate the RMD during the participant or IRA owners life. Step 1 Life Expectancy.

Step 3 Determine IRA Value. Required Minimum Distribution RMD is the amount the IRS requires the owner of an Individual Retirement Account IRA to withdrawal each year. 9 rows This chart highlights some of the basic RMD rules as applied to IRAs and defined.

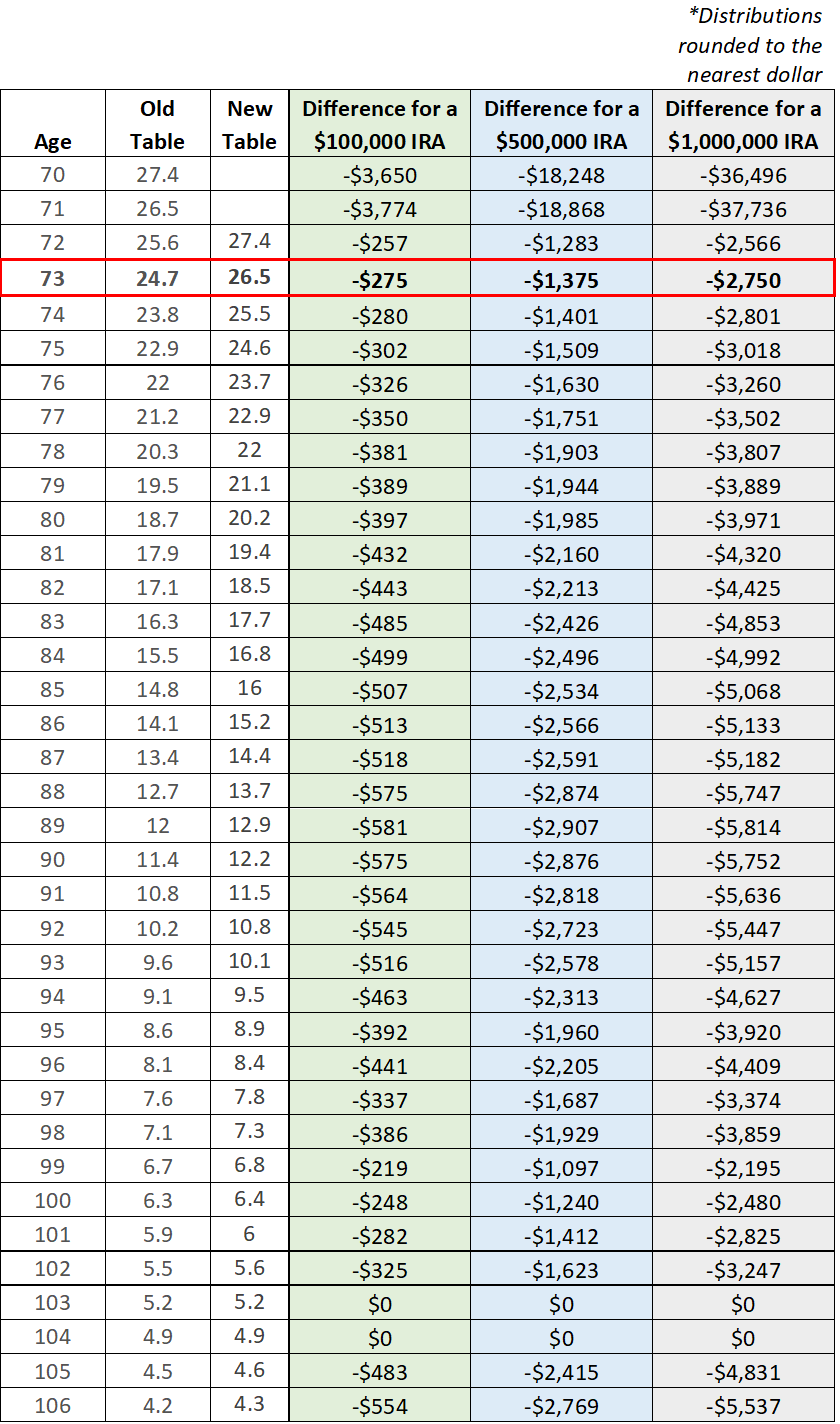

For an IRA with a balance of 700000 on 12312021 the difference in RMD is 28455 new table versus 30568 old table. Year you turn age 72 70 ½ if you reached 70 ½ before January 1 2020 - by April 1 of the following year. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year.

Table III Uniform Lifetime Age Distribution Period Age Distribution Period Age Distribution Period Age Distribution Period 70 17127482. Generally a RMD is calculated for each account by dividing the prior December 31 balance of that IRA or retirement plan account by a life expectancy factor that the IRS publishes in Tables in. Its called the Required Minimum Distributions RMD.

Strategies To Reduce Or Delay Rmd Mandatory Withdrawals Required Minimum Distribution Content Strategy Strategies

Rmd Table Rules Requirements By Account Type

Sjcomeup Com Rmd Distribution Table

How Recent Changes To Required Minimum Distribution Rules May Affect Future Value Tsp Accounts

Required Distributions On Inherited Retirement Accounts Reduced In 2022 Putnam Wealth Management

How Required Minimum Distributions Work Merriman

Strategies To Reduce Or Delay Rmd Mandatory Withdrawals Required Minimum Distribution Content Strategy Strategies

Where Are Those New Rmd Tables For 2022

Sjcomeup Com Rmd Distribution Table

Your Search For The New Life Expectancy Tables Is Over Ascensus

Is There New Required Minimum Rmd Tables For 2022 Michael Ryan Money Financial Coach

Rmd Table Rules Requirements By Account Type

New Tables Are Available For Calculating Required Minimum Distributions Rmds In 2022 Julie Jason

What Is A Required Minimum Distribution Taylor Hoffman

What Do The New Irs Life Expectancy Tables Mean To You Glassman Wealth Services

Sjcomeup Com Rmd Distribution Table

Rmds Required Minimum Distributions Top Ten Questions Answered Mrb Accounting 516 427 7313